VitamINSIGHTS

Australia nutra trends: Market leaders Blackmores, Swisse gearing up on mental health, sleep products

Also termed as complementary medicines, nutraceuticals in Australia are regulated by the Therapeutic Goods Administration – a unit under the Department of Health and Aged Care.

While they can be sold in health food shops, supermarkets, and pharmacies, most must be included on the Australian Register of Therapeutic Goods (ARTG) before they can be sold.

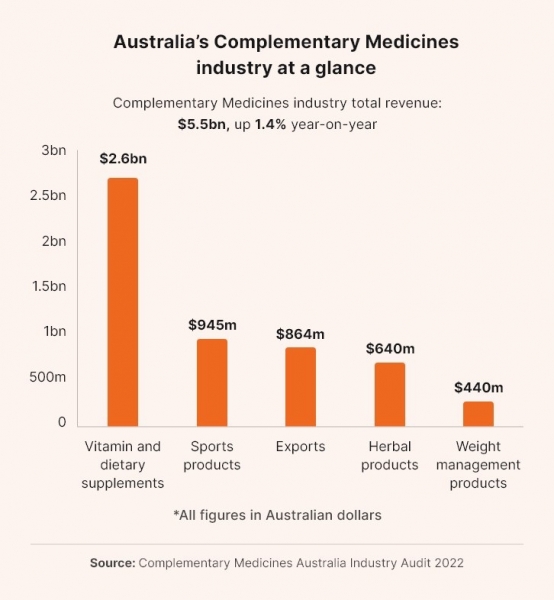

Generating a revenue of AUD$5.5bn (US$3.7bn), which was an increase of 1.4 per cent, the bulk of the revenue came from vitamin and dietary supplements, followed by sports products, said the Industry Audit report 2022 by Complementary Medicine Australia (CMA) – an industry body with 150 companies as members.

As one of the most developed nutraceutical markets in Asia-Pacific, the market is led by local brands which have since expanded further afield, such as Blackmores and Swisse, with various emerging brands competing for a piece of the market. Blackmores has been in the spotlight for the past week as it was targeted for acquisition by Japan brewery giant Kirin.

Asked if the market has come to a point of saturation, Carl Gibson, vice president of the International Alliance of Dietary/Food Supplement Associations (IADSA) disagrees and is in fact, confident that the market will grow at roughly four per cent this year.

Carl is also the former CEO of CMA who retired from the post last week.

“Yes, Australia is a mature but also a growing market. In our last few industry audits, we have seen good steady growth. This year, we are looking at around four per cent increase in sales across the board.

“Australia is a good, solid, and mature market,” said Gibson.

According to his observations, the increased social interactions and less attention on hygiene practices in the post COVID-19 era are leading to a greater uptake in complementary medicines for cold and flu.

Herbs of Gold, a complementary medicine brand that has been growing its presence across Australia’s pharmacies, concurred with the above.

As a result of COVID-19, there has been a spike in immunity and stress related products in Australia, Shaun Rutherford, CEO of Herbs of Gold ANZ said.

“There is still higher demand for immunity products than pre-COVID,” he said.

In its latest financial report, Health and Happiness Group (H&H Group), the parent firm of Swisse, said sales went up by 18.6 per cent in Australia and New Zealand between the first quarter of this year and last year.

Growing demand for immune products was cited as one of the reasons for its strong performance.

In this series of VitamINSIGHTS, NutraIngredients-Asia will reveal the trending health concerns, consumer purchasing behaviour, and new product development focus through interviews with the IADSA, Blackmores, Swisse, and Herbs of Gold.

Part I: Mental wellbeing ‘an overarching trend’, sleep a fast-growing segment

Mental wellbeing was consistently cited as the trending health consumer concern from the three complementary medicines brand, while sleep was said to be a small but fast growing segment.

Blackmores’ group marketing director Meg Farquhar described this as “an overarching trend”.

“Probably the biggest shift that consumers have made or the awareness that consumers now have [post COVID-19], is really the link between a person's physical health and their mental wellbeing.

“We're seeing that [consumers’ awareness] as an overarching trend…This is not something new for us, but it is an emerging trend from a consumer perspective.”

Earlier this year, Blackmores launched Ache Relief + Focus targeted at supporting muscle health and mental focus, developed to address problems connected to physical and mental health.

On top of mental wellbeing, sleep aid is another area seeing fast growth driven by the millennials. In fact, Farquhar highlighted sleep as “the first immediate opportunity for new product development.”

“Sleep is one of the smallest but fastest growing segments in Australia.

“Sleep is a space played out by traditional pharmaceuticals, not so much a space that VDS has been into. Consumers have a better understanding of how sleep would impact wellness and millennials are seeking natural and efficacious solutions for their sleep problem,” she said.

Farquhar dissects the trending health concerns, including mental wellbeing and sleep in the following video.

Swisse also saw interest peaked in its stress and sleep portfolio.

Functional food formats, such as gummies, are particularly popular, said associate marketing director, Ana Laskova. The Swisse Me range was especially popular among Gen Z consumers, the firm said in its financial year 2022 annual report.

“Across the Swisse range, we have seen interest peak in the stress and sleep portfolio, particularly in new convenient formats like gummies as consumers are favouring on the go style formats that can be incorporated into their busy regime in a fun and efficacious way.

“With the growing awareness and understanding of the impact of lifestyle and nutrition on mental wellbeing, we predict that proactive approaches to managing stress and improving sleep will continue to grow.”

Laskova said that Swisse would be tapping into both efficacious ingredients and disruptive formats for new product development.

In terms of functional foods for sleep, Australia’s The Mood Food Company would be launching a functional food bar “The Restful Bar” containing naturally rich amounts of melatonin, tryptophan, and magnesium for support sleep in May.

Each of these bars has been validated to contain 3.4n of melatonin, 32.5mg of magnesium, and 54.3mg of tryptophan from the use of sour cherries, roasted almond, and Australian pumpkin seeds respectively.

For Herbs of Gold, it is similarly saw “a movement to” products related to stress and sleep.

Its product, Stress Ease, which contains rhodiola and ashwagandha for “healthy stress response” is said to be one of the brand’s bestsellers in Australia, alongside its Activated B Complex, Quercetin, Magnesium Forte, Triple Strength Omega, and Ubiquinol.

Part II: Other trending areas – Beauty-from-within, mobility, eye health

Beauty-from-within, mobility, eye health were the other trending demands that the brands are seeing.

Blackmores, in particularly, has noticed that younger consumers are taking an interest in products supporting movement, although the space is traditionally about sports performance.

“Consumers are becoming aware that any type of movement will affect their wellbeing, while traditionally, movement is very much about sports performance or movement for weight management.

“There are a lot of NPD opportunities for younger consumers who are looking to maximise movements in their lives, which isn’t necessarily associated with a chronic condition,” said Farquhar.

She cited the product “The Everyday Vitality” as an example of the firm’s NPD endeavour in this area.

“This product is about everyday vitality and everyday health for everybody. It is a power engine and will continue to grow.”

Swisse, on the other hand, with its expertise in beauty-from-within, is hoping to drive further growth in Australia via this category.

In its first quarter financial report for this year, immunity, beauty nutrition, and general wellness were highlighted as the key sectors contributing to strong performance.

“We will continue to pave the way to reclaim our domestic leadership position and gain market share by driving growth in our core categories of immunity, beauty nutrition and general wellness-supporting products catering to the needs of domestic customers,” H&H Group said in its latest financial report.

Laskova said that collagen was a key ingredient that would continue to push growth and innovation in this category.

“We have seen incredible success across our beauty portfolio, one of our latest with the Swisse Beauty Collagen + Hyaluronic Acid Booster one of our best performing new products.

“We are expecting beauty to continue to blur the lines with key need states such as stress, hormone health, gut health as the directional beauty connection is better understood by savvy beauty consumers,” she said.

Closely related to beauty-from-within is the weight management category which Gibson said was trending as consumers sought to shed away extra weight gained during COVID-19.

“We are seeing interest in the weight loss products, as people are looking to shed those extra COVID-19 kilos,” he said.

Part III: Preference for big value pack as cost-of-living increases

Apart from the trending categories, inflation and rising cost-of-living mean that consumers are preferring to buy complementary medicines that they are confident in in big value packs.

In period of economic uncertainties, consumers gravitate towards brands and products that they trust.

So we are seeing this with multivitamins, immunity, where consumers know that these products work, have multiple benefits, and consumers are buying this because they want the assurance that they are not wasting.

In terms of new models and what consumers are looking for in the current economic environment, is that can also be reflected in larger pack sizes. Whilst there can be a bigger outlay for consumers, it is actually a value offering over a period of time.

- Blackmores’ group marketing director Meg Farquhar

The purchase of these big value packs, she said, was mainly taking place in discount pharmacies and grocery stores.

Since consumers are gravitating towards familiar products and ingredients, it would be crucial for firms to convey the benefits of new products using novel ingredients using terms that consumers can relate to.

“When launching novel products, it’s about grounding the product benefit in a very strong consumer insight and the ingredient becomes the support or the reason to believe [in the product].”

Herbs of Gold also saw that the basket size for complementary medicines for health foods and pharmacy channels have increased.

“The consumers were buying more products where they may ordinarily say buy one or two products of a brand. They were walking in to buying say up to three, four, five products of other brands, because of the need to shop on immunity, stress, and sleep,” said Rutherford.

Part IV: The retail channels

Pharmacies remains the key retail channel for complementary medicines, but grocery stores and e-commerce are also becoming the go-to channel for firms.

Herbs of Gold, for example, has been expanding aggressively in the pharmacy channels four years ago, a shift from its initial focus in the health food retail scene.

So far, it is present in nearly 1,400 pharmacies in Australia. There are about 6,000 pharmacies across the country.

“Herbs of Gold started in 1989. The brand has been in the health food retail channel 100 per cent.

“Health foods is still a big part of our business, it's the biggest channel for us and it's a channel that's still growing and performing well, although we are seeing a consolidation of health foods stores, where we're either seeing some stores closing or a consolidation where stores are joining,” Rutherford said, adding that Go Vita was most probably the biggest retail banner left in the health foods space.

“Health foods is still very strategic and important for us, we want to maintain the sales and for us it's a bit of breeding ground for launching and developing products.

“There's a lot of naturopaths that sit on the health foods space with a lot of expertise, so that channel is still very important for us to continue to foster our products and growth,” he said.

Swisse, on the other hand, said that pharmacy, grocery and direct-to-consumers are key retail channels when it comes to purchasing vitamins as these channels offered a wide breadth of products.

Renovatio, for example, is a brand that has seen opportunities in the grocery sector.

The brand last year launched its mental wellbeing product in supermarket chain Woolworths, as it saw that consumers have started to purchase supplements as part of their grocery shopping.

As for e-commerce and livestreaming, Blackmores has been seeing double-digit growth from it and said that it would be a focus moving forward.

Part V: Regulatory challenges

Asked the regulatory challenges, Gibson pointed out the issue of how some ingredients, such as caffeine, traditionally sold as functional or sports foods, might be considered as therapeutic goods. This would in turn affect the manufacturing costs and barriers for firms.

“This means companies would need to have a higher manufacturing level to reach the requirement stated by the TGA. This could also double or triple their manufacturing cost.

“We constantly have a challenge with our regulators on the issue of caffeine, and that’s under discussion at the moment about what caffeine levels should be,” he said.

Watch Gibson explain more about the industry challenges.

The Food Standards Australia New Zealand (FSANZ) proposed to limit caffeine consumption through sports foods last year.

It proposed to permit total caffeine in Formulated Supplementary Sports Foods to a maximum of 200mg in a one-day quantity. New product labelling is needed to display this information.

“In the future, you are going to see two sets of sports supplements in the marketplace. There will be those with sports supplements therapeutic claims and those with purely food claims.

“It will be interesting to see how the market reacts to two completely different categories of the same product in retail, which are 1) those with therapeutic claims and 2) those with low level claims.”

At the moment, some of the sports supplement manufacturers using caffeine have decided to reformulate their products, while some have decided to exit the business.